Medicare tax calculation 2023

Heres what you need to know. 26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA.

Calendar Year 2023 Medicare Physician Fee Schedule Proposed Rule Part 2 Youtube

For 2024 IRMAA your forecast is 101000 with zero.

. Monthly Medicare Premiums for 2022. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

2023005 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. The Medicare tax rate is 29 of your income. The Additional Medicare Tax.

So before 65 if you want premium ACA. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Social Security and Medicare Withholding Rates.

Whats The Current Medicare Tax Rate. Still only the taxable portion of social security is added back on the MAGI calculation for Medicare. Days 101 and beyond.

This Tax Calculator Lets You Estimate Your Taxes. On the other hand if you make more than 200000 annually you will pay. In 2021 the Medicare tax rate is 145.

Estimate in 2022 and e-File in 2023. What is a 202301k after tax. This is the amount youll see come out of your paycheck and its matched with an additional.

CNBC reported that a recent congressional. If you work for an employer you pay half of it and your employer pays the other half 145 of your wages each. Today the Centers for Medicare Medicaid Services CMS released the Announcement of Calendar Year CY 2023 Medicare Advantage MA Capitation Rates and.

As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. You may get a reduction or exemption from paying the Medicare levy depending on. 19450 copayment each day.

Prepare and e-File your. Begin tax planning using the 2023 Return Calculator below. 0 for covered home health care services.

The standard Part B premium for 2022 is 17010. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. If youre single and filed an individual tax return or married and filed a joint tax return the following.

You pay all costs. Tax Planning Consideration for IRMAA 2023. 2023258 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations.

What is a 202326k after tax. Based on your forecast It is pretty sure that the 2023 IRMAA will be around 97000 or 98000 for individual or MFS. Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line.

It will be updated with 2023 tax year data as soon the data is available from the IRS. As you begin the process of filing 2021 taxes you should be aware that what goes on a completed Form 1040 will have an impact on what premiums you will be paying in 2023.

Early Social Security Ssi Cola Predictions For 2023 Youtube

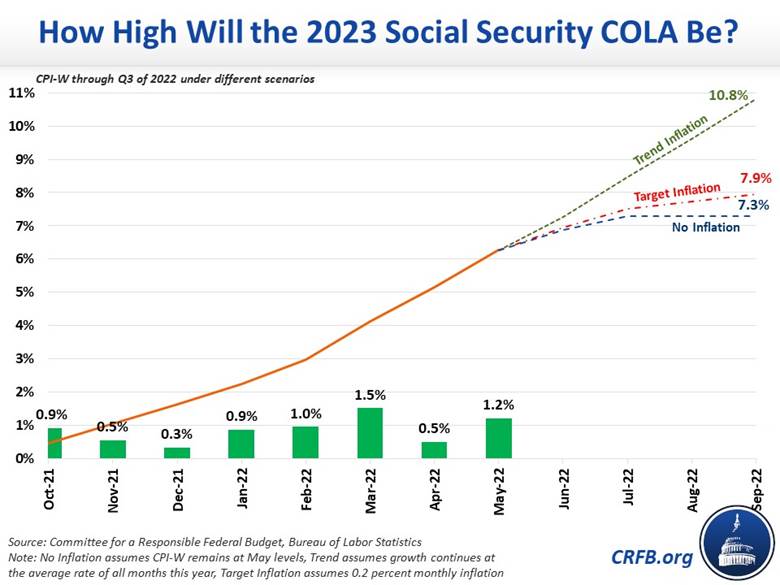

Could 2023 Social Security Cola Hit 9 Benefitspro

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

2023 San Francisco Hcso Expenditure Rates Released

You Won T Believe The Size Of This 2023 Social Security Cola Estimate 401 K Specialist

Moaa Here S Why Your Medicare Part B Costs May Drop In 2023

Social Security Benefits To See Major Bump

Medicare And Taxes How Your 2023 Medicare Premiums Are Affected By Your 2021 Tax Filing Gobankingrates

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

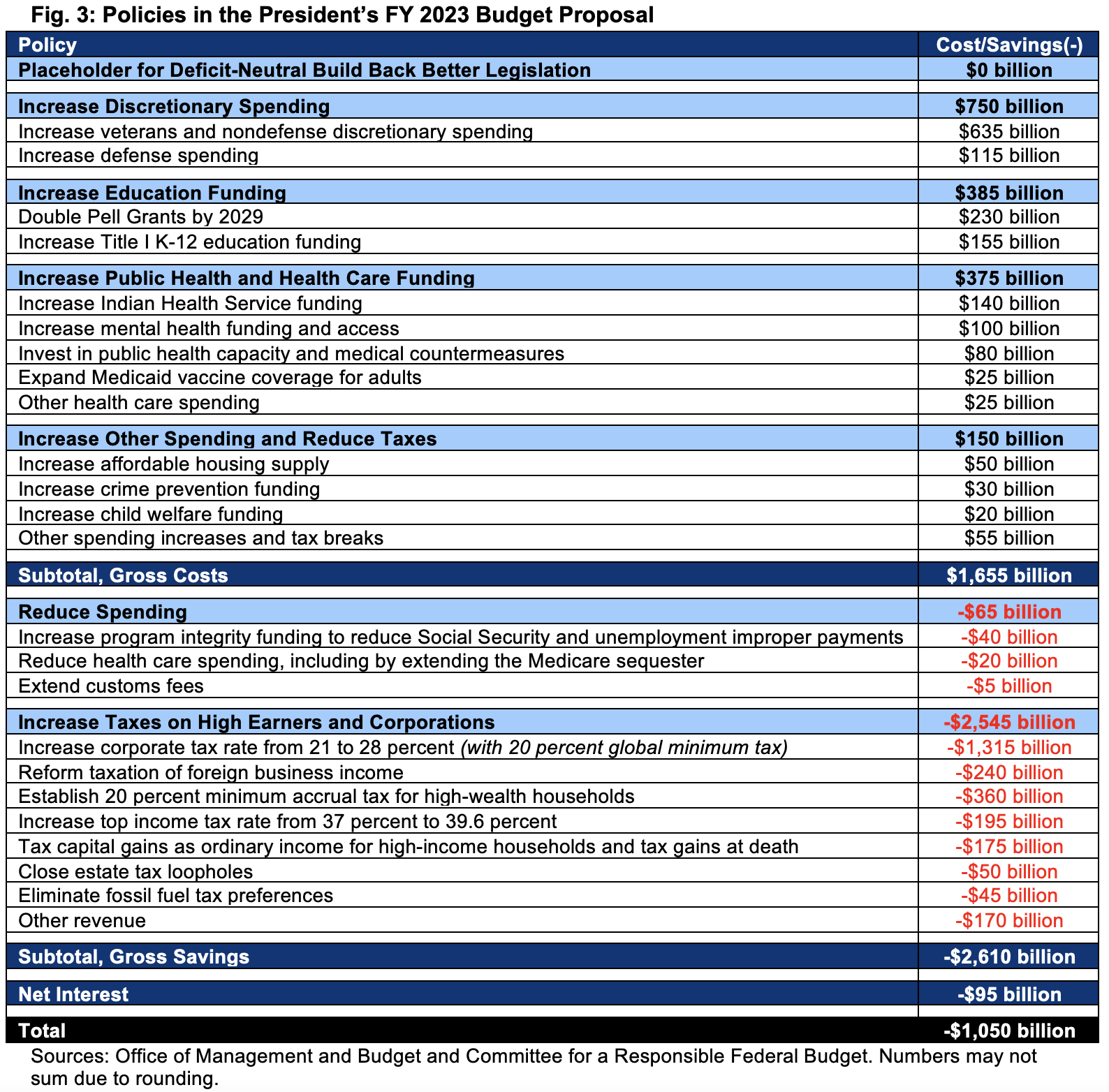

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Social Security What Is The Wage Base For 2023 Gobankingrates

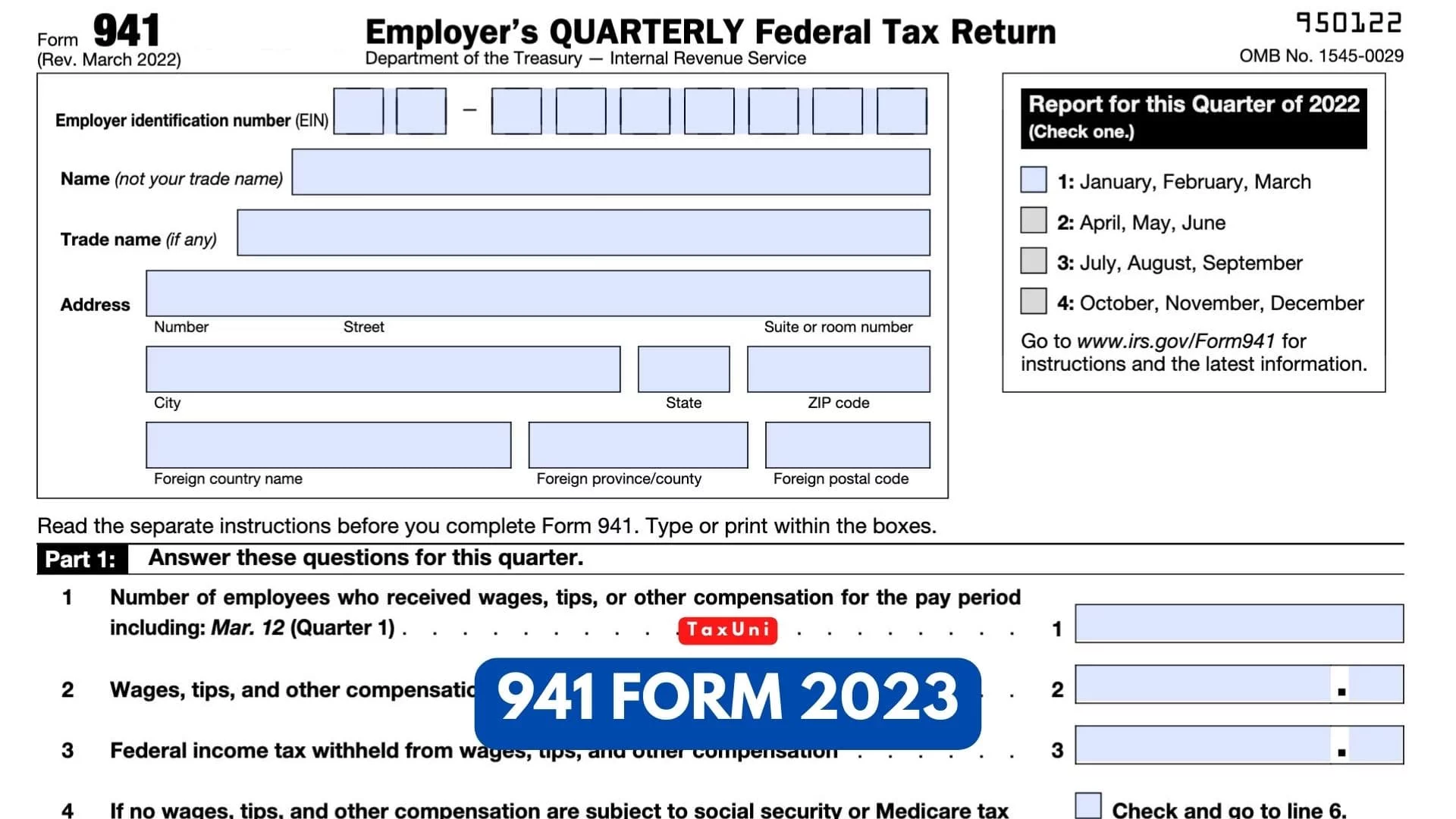

941 Form 2023

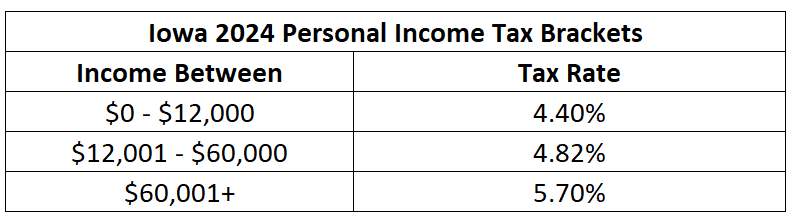

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

What Is The Maximum Taxable Income For Social Security For 2023 Gobankingrates

Form 941 For 2023

Social Security Estimate For 2023 Cola Pushes Into Double Digits After Latest Inflation Report